The pandemic broke just as the cabin and glamping nature vacations were on the rise and the rural or isolated family holiday dominated traveler demand lists. With many international trips canceled, staycations, flexations, and being a tourist in your own country have become the new normal. So, let’s have a glance at the latest vacation rental statistics to see what else has been going on in the industry lately and how it is recovering in the post-pandemic world.

Vacation Rental Statistics (Editor’s Choice)

- The global vacation rental market will grow to $119 billion in 2030. (Grandview Research)

- Agoda and Vrbo extended their max stay duration from 32 to 180 days. (Rental Scale Up)

- The number of vacation rental users will rise to 62.9 million in 2026. (Statista)

- Globally, there are 140,674 vacation rental companies. (iProperty Management)

- 31% of travelers said family time is their primary travel goal. (Avantio)

- 37% of people planned to book a vacation stay to work from. (Rental Scale Up)

- Vrbo spent over 10 times what Airbnb did on US advertising. (Wall Street Journal)

Vacation Rental Industry Statistics

1. The global vacation rental market is projected to reach $119 billion by 2030.

The compound annual growth rate for the global vacation rental market is expected to come in at 5.3% for the period from 2022 to 2030. The vacation rental market size is set to benefit from rising expenditure on travel, vacations, and accommodation, especially among millennials.

(Grandview Research)

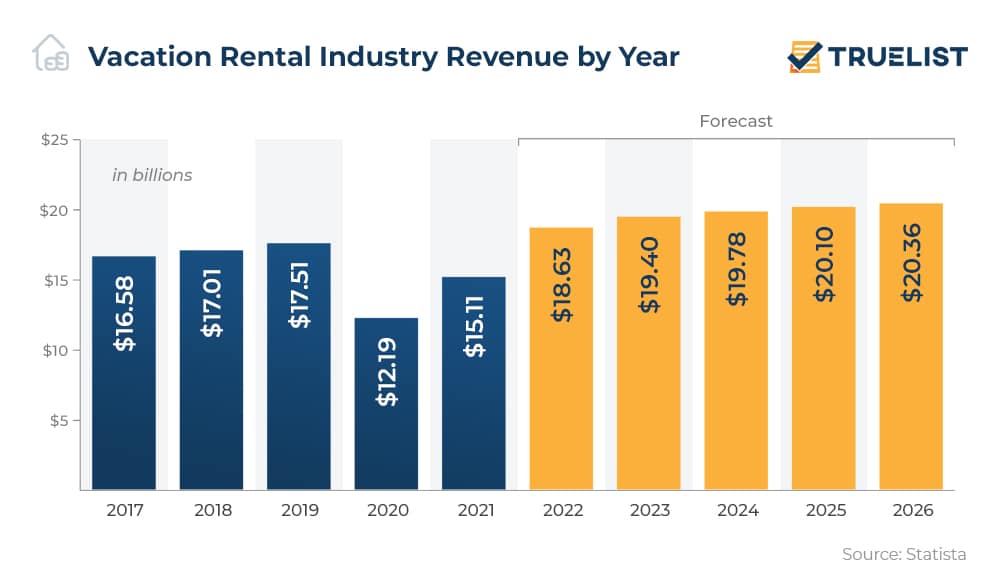

2. The vacation rental industry’s revenue is planned to reach $19.4 billion in 2023.

The projected CAGR for the period from 2022 to 2026 is 2.24%, implying a market volume of $20.36 billion by 2026. Vacation rental guest statistics show that the average revenue per person will amount to $305.80 with the user penetration going up to 18.4% by 2026, from the current 18.2% in 2022.

(Statista)

3. There are 25,000 vacation rental companies in the US, as of July 2022.

Worldwide, there are 140,674 vacation rental companies, with 20% of rental units located in the US and 35% in Europe. Vacation rentals account for 31.3% of all privately owned accommodations stateside.

(iProperty Management)

4. The resort/condo segment is set to register a 6.1% GAGR from 2022 to 2030.

Short-term vacation rental statistics show that this segment will outperform the market due to demand from millennials, which represent the largest group of travelers. This age group is also more inclined on spending on amenities such as swimming pools, barbecue pits, and games.

(Grandview Research)

5. Millennials choose short-term rentals instead of hotels most of the time.

Up to 40% of people who book holidays online are millennials and they are abandoning booking hotels, according to millennial vacation rental statistics. Gen Z meanwhile likes to go on trips with friends, with 35% choosing them over family or solo trips. The switch from city breaks to rural destinations is the most prominent in this age group with 60% of Gen Z switching to nature-oriented holidays instead of cities.

(iProperty Management)

6. Around 37% of people have considered booking a stay at another destination to work from.

In the midst of the pandemic years, travel and work merged like never before. Flexible school schedules and remote work setup made it possible and sometimes prudent to travel out of the cities into rural areas, as evidenced by vacation rental statistics. A Vrbo occupancy rates survey found that 50% of families said flexible school schedules allow for traveling and up 48% reported that they could work from any location. Remote work statistics in an Airbnb survey meanwhile showed that 83% of respondents would consider relocating while working remotely.

(Rental Scale Up)

7. Up to 95% of people say that their plans were influenced by something they saw in a travel brochure.

Vacation rental marketing statistics underscore the influence of print materials, showing that this marketing medium is not dead yet. 83% of travelers report having made plans to visit a business or attraction highlighted in brochures, maps, or guides, while 78% thought of changing their plans because of something they saw in a brochure.

(iProperty Management)

8. Agoda and Vrbo have extended their maximum stay from 32 to 180 days.

Vrbo statistics have shown the need for longer stays and the platforms seem to be adapting accordingly. Airbnb dropped Airbnb for work and changed it to a simpler laptop-friendly option instead of a full listing of properties listings, with high-speed wi-fi proving to be the key element people looked for. In addition, the platform has been promoting monthly stays as a part of remote work and travel offers.

(Rental Scale Up)

9. Up to 82% of families were still planning future trips while in lockdowns.

Maintaining mental health during the pandemic has proven to be a great motivator for travel for 21% of people. As everyone spent the first half of 2020 in their homes, the planning still continued, with one in three families planning their “revenge vacations,” vacation rental statistics show. This meant a willingness to be spending more, travel to remote destinations as well as stay longer on future vacations.

(Avantio)

10. Around 57% of property managers noticed more bookings from people planning to work during the vacation.

In addition to that, 43% of property managers reported guests opting for longer stays than usual. 38% further said they wanted a new experience for their children to run from the monotony of staying in one place during lockdowns.

(Avantio)

11. Some 10% of all US travel reservations before March 2020 were for short-term rentals.

Short-term rental statistics show that short stays from one to seven days made up for 79% of bookings before the pandemic. This number dropped to 30% in March 2020 only to rebound to 59% by December, according to short-term rental market data.

(iProperty Management)

12. Up to 59% of Americans were more likely to drive than fly the next time they travel.

This was slightly below European averages where 71% of German and 68% of Spanish travelers would choose their cars over planes. Vacation property rental market statistics show that being a tourist in your own country has had a forced revival, with people flocking to work and travel destinations close to home or within a comfortable driving distance.

(Avantio)

13. Nine out of 10 Europeans are choosing rural vacation units.

American families go to rural locations in 61% of cases. Lake and riverside rentals demand rose by 25%. Due to irregular flight schedules, constant changes in Covid restrictions, and differences among countries, crossing borders and visiting cities has dropped drastically compared to staying in nature close to home, vacation rental statistics by location show.

(Avantio)

14. Private room accommodation has dropped in demand by 99%.

On the other hand, the demand for cabins has skyrocketed, growing by 80%. A similar case was with villas and bungalows with the rise in popularity of 61% and 60%, showing how isolated units have become the most sought-after type of accommodation in the past two years.

(iProperty Management)

15. Domestic travel spending dropped 36% from 2019 to 2020.

Domestic vacation rental industry statistics reveal further losses suffered at the height of the pandemic:

- The economic output generated by travel declined by $1.1 trillion or 42%.

- 35% of jobs lost in 2020 represented direct travel jobs.

- International travel spending dropped by 79%.

- Travel-related tax revenue declined by 34%.

(iProperty Management)

16. European travelers have increased their average vacation stay length by 190%.

The number of stays longer than seven days has doubled compared to 2019. This underscores the trend of people looking to work away from home at the time of the pandemic, with 57% of property owners reporting they had more bookings where travelers signaled they were planning to work during their holiday. Vacation rental growth statistics show agencies should advertise features such as good quality internet and comfortable desks, as this trend is likely to continue.

(Avantio)

17. Up to 90% of European property managers made cancellation policies flexible.

Since 2020 saw so many cancellations the need for a more flexible policy was evident and around 52% of managers not only relaxed their rules but considered offering free cancellation in 2021. A lot of managers also turned to property management software to handle the rise in last-minute bookings and cancellations. Vacation rental online statistics show that a full 90% of property managers reported that last-minute bookings had gone up and introduced instant booking as an option recognizing the benefits of automation.

(Avantio)

18. Up to 85.9% of vacation rental companies named automation as a priority for the oncoming period.

82.4% of vacation rental property managers meanwhile consider keyless technology, contactless check-ins, and smart home devices. Vacation rental statistics show that guests have come to expect and look for contactless service and companies recognize that automation will change the travel industry for the better and, as a result, are turning to the use of vacation rental software.

(Avantio)

19. Up to 71% of families with children named the option to cook their own food as a primary reason to choose a rental unit.

The pandemic has altered traveler requirements, bringing out cleanliness and high-speed internet at the forefront of vacation rental demand, especially among those looking for flexations. For families, however, the option to cook their own meals and get access to a good kitchen in the rental unit was the key element when choosing where to stay with their children, vacation rental trends show.

(iProperty Management)

20. Airbnb operates in 100,000 cities across the world.

In the fourth quarter of 2020, the platform had 5.6 million active listings and 4 million hosts, and around 200 guests checking in by the minute. Among the classic homes, flats, cabins, condos, and rooms, there were some of the following listings to be found:

- 24,000 tiny homes

- 3,500 castles

- 2,600 treehouses

The Vrbo market share does not seem to endanger the short-term rental platform as much as it was expected, Airbnb statistics show, with Vrbo focusing on renting whole properties.

(Wall Street Journal, Hotel Tech Report)

21. Vacation rental market data shows that with 38.1%, Miami had the highest occupancy rates in 2021.

Despite being only ninth in the number of listings on Airbnb, Miami has the highest occupancy rates. Vacation rental occupancy rates by city on the platform meanwhile show the top three locations for 2021 were New York City, Los Angeles, and, surprisingly, Kissimmee, Florida.

(All the Rooms)

The Bottom Line

Being cooped up at home for months on end, gave everyone cabin fever, however, for quite a while, there was nothing to be done about that. Challenges made the vacation rental industry push new solutions to the front and advertise a different type of traveling, focusing on longer stays and close-to-home-work-friendly vacation spots and units. Vacation rental statistics meanwhile show that regardless of the turn the pandemic will take, new practices are here to stay, most notably technological improvements as property owners look to become more flexible amid waves of last-minute bookings and cancellations.

Sources: Grandview Research, Rental Scale Up, Statista, iProperty Management, Avantio, Wall Street Journal, Hotel Tech Report, All the Rooms